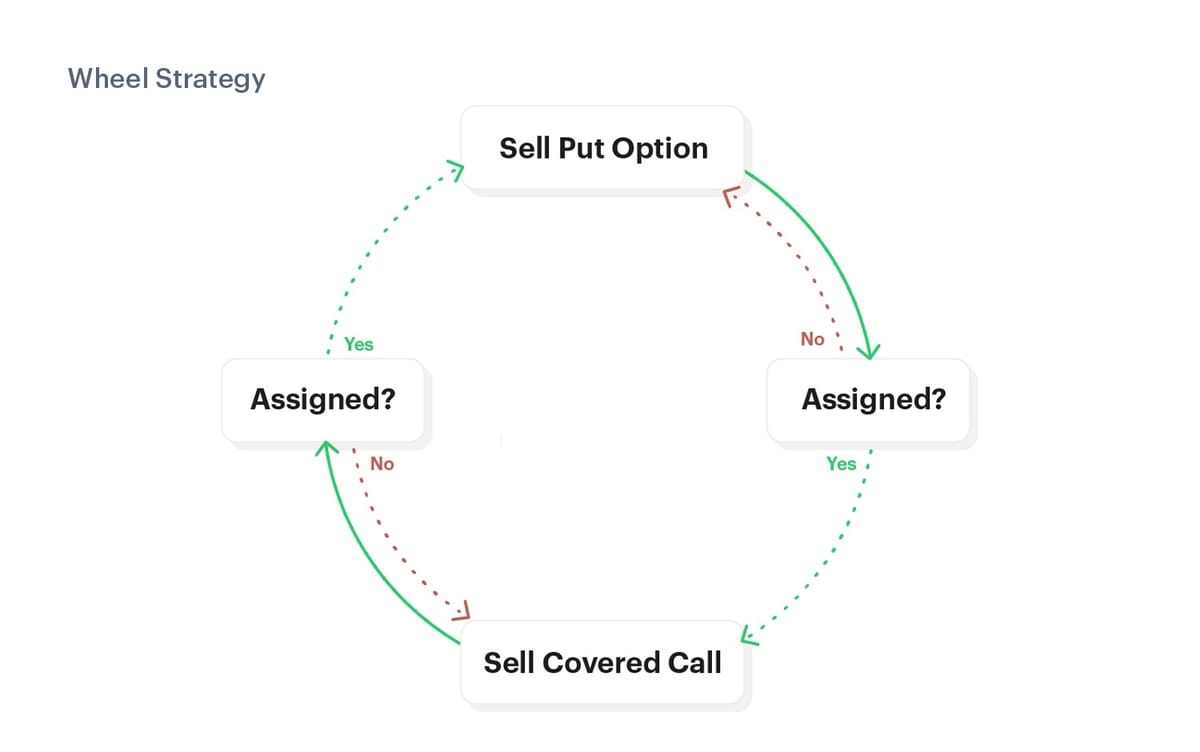

Options Wheel strategy

The Options Wheel Strategy is a systematic way to generate income by selling options, typically using cash-secured puts and covered calls. Here's how it works with Stock X:

Step 1: Sell a Cash-Secured Put on X

- You sell a put option at a strike price you’re comfortable buying X at.

- If the option expires worthless, you keep the premium and can sell another put.

- If the option is assigned, you buy 100 shares of X at the strike price.

Step 2: Sell a Covered Call on X

- After owning X, you sell a covered call at a higher strike price.

- If the stock stays below the strike, you keep the shares and the premium.

- If the stock rises above the strike, your shares get called away, but you profit from the sale plus the premium.

Step 3: Repeat

- If shares are assigned, restart the cycle by selling another cash-secured put.

- This strategy generates steady income but works best in a sideways or mildly bullish market.

Example with a numbers

Here's an example of the Options Wheel Strategy using Stock X, which is currently trading at $100:

Step 1: Sell a Cash-Secured Put

- You sell a Put Option with a strike price of $95 for a premium of $3.

- Two possible outcomes at expiration:

- 1️⃣ Stock stays above $95:

- The option expires worthless.

- You keep the $3 premium (profit).

- Repeat by selling another put.

- 2️⃣ Stock falls below $95:

- The option is assigned, and you buy 100 shares at $95.

- Effective cost per share: $95 - $3 = $92 (because of the premium received).

- 1️⃣ Stock stays above $95:

Step 2: Sell a Covered Call

Now that you own 100 shares at $95, you sell a Call Option at a strike price of $105 for a $2 premium.

Two possible outcomes at expiration:

- 1️⃣ Stock stays below $105:

- The option expires worthless.

- You keep the $2 premium (profit).

- You still own 100 shares and can sell another covered call.

- 2️⃣ Stock rises above $105:

- Your shares are called away at $105.

- Total profit:

- ($105 - $95) = $10 per share from stock appreciation.

- $3 (Put Premium) + $2 (Call Premium) = $5 per share from options income.

- Total profit = $15 per share or $1,500 per 100 shares.

- Restart the wheel by selling another cash-secured put.

Risk & Reward Breakdown for the Options Wheel Strategy

✅ Potential Rewards

- Premium Income – You consistently earn premiums from selling puts and calls.

- Stock Appreciation – If assigned, you can profit from the stock increasing in value.

- Lower Cost Basis – Selling puts reduces your entry price, and selling calls boosts overall returns.

- Repeatable Strategy – You can keep cycling through puts and calls for consistent income.

⚠️ Potential Risks

- Stock Drops Below Put Strike ($95)

- If X drops to $80, you must buy it at $95, suffering an unrealized $15 loss per share.

- However, your actual loss is $12 per share due to the $3 premium collected.

- You can manage this by selling covered calls or holding long-term.

- Stock Rises Too Fast (Above Call Strike $105)

- If S skyrockets to $120, you’re forced to sell at $105 and miss out on extra gains.

- Your profit is capped at $15 per share, even though the stock moved $20+ higher.

- Bear Market Risk

- If the stock crashes below your put strike, you’re holding a losing position.

- If it drops below $92 (your cost basis), you’re in a net loss.

- Selling covered calls at lower strikes can help but limits recovery upside.

- Low Volatility = Lower Premiums

- If options premiums are too low, the income might not justify the risk.

Risk Management Tips

- Choose solid stocks with strong fundamentals to avoid major crashes.

- Sell puts at support levels where you’d be comfortable owning the stock.

- Use stop losses or rolling strategies to manage positions.

- Avoid overleveraging—don’t sell too many puts beyond your buying power.